Super Micro Computer Stock: Key Insights Trends and Market Performance

Due to its cutting-edge server and storage solutions, Super Micro Computer Inc. (NASDAQ: SMCI) has attracted considerable interest in the technology and stock market sectors. Due to the company’s vital involvement in high-performance computing, artificial intelligence (AI), and cloud-based infrastructure, its stock is an intriguing option for investors. The article examines the company’s history, stock performance, market trends, financial highlights, and investment potential.

Table of Contents

Company Background

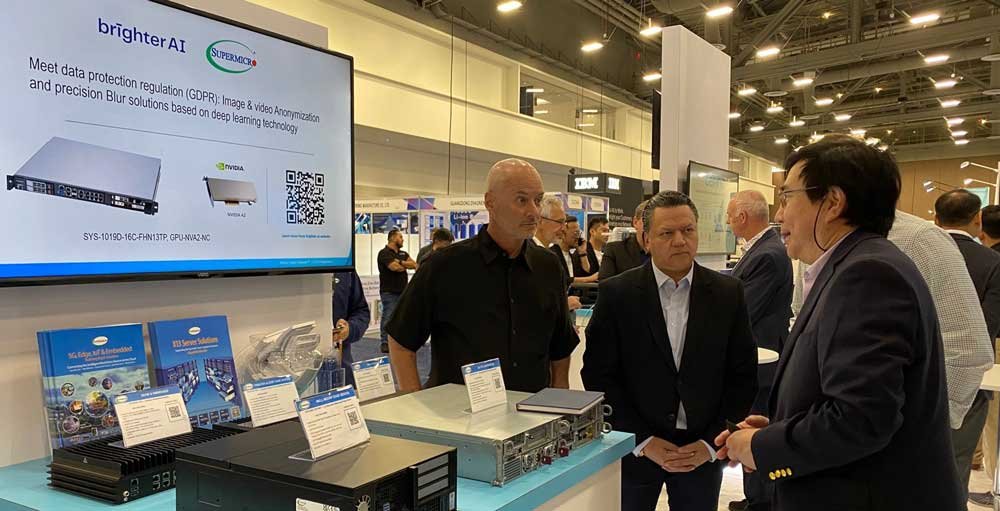

Founded in 1993, Super Micro Computer specializes in high-performance computing, edge computing, and AI-driven infrastructure solutions. The firm offers server solutions that are energy-efficient and scalable, designed for enterprises, cloud providers, and data centers. With its robust foothold in the markets of AI and machine learning, it stands as a competitive entity within the tech industry.

Recent Stock Performance

Super Micro Computer’s shares have demonstrated remarkable growth over the past few years, fueled by the rising need for AI-driven data centers. Although the stock has been subject to volatility owing to changes in the tech sector, it continues to outperform its industry counterparts. Analysts have observed robust earnings reports, with revenue growth corresponding to the increasing enterprise demand for cloud and AI computing.

Market Trends Affecting the Stock

- Several key trends are influencing SMCI’s stock performance:

- AI Boom: The rise of AI and machine learning applications has increased demand for Super Micro’s high-performance computing solutions.

- Cloud Computing Growth: More businesses are shifting to cloud-based solutions, boosting the need for energy-efficient server technology.

- Supply Chain Challenges: While global supply chain disruptions have affected the tech sector, SMCI has managed to navigate these issues efficiently.

Financial Highlights

- Revenue Growth: Super Micro has consistently posted strong revenue growth, benefiting from the surge in AI and cloud computing investments.

- Profitability: The company maintains solid profit margins due to its efficient manufacturing and supply chain strategies.

- Earnings Reports: Quarterly earnings have frequently exceeded analyst expectations, reinforcing investor confidence.

- Competitive Landscape: The company competes with giants like Dell, HPE, and Lenovo but differentiates itself with custom-built server solutions.

Reasons Investors Are Interested

- AI and Data Center Expansion: SMCI’s role in AI-driven data centers is a key driver for long-term growth

- Strong Financials: Consistent revenue and earnings growth make it a promising investment.

- Tech Industry Growth: The expanding tech sector supports continued demand for SMCI’s products.

Risks to Consider

- Stock Volatility: The tech sector is known for fluctuations, which can impact SMCI’s stock price.

- Competition: Larger competitors may challenge its market share.

- Macroeconomic Factors: Inflation, interest rates, and global supply chain disruptions can affect stock performance.

Future Outlook

Super Micro Computer is set for growth owing to the rising adoption of AI and advancements in cloud computing. Although stock volatility is still a worry, analysts continue to have a positive outlook for its future. While the business may appeal to investors with a long-term outlook, those trading in the short term ought to brace for volatility.

Should You Invest?

Due to Super Micro Computer robust financial situation, its market positioning driven by AI, and the increasing demand for high-performance computing, it is a stock worth considering. Nonetheless, before deciding, prospective investors ought to take into account the risks and fluctuations of the market. It is advisable to consult a financial advisor prior to making investments.

Conclusion

Super Micro Computer has positioned itself as a top contender in the realms of AI-driven computing and cloud solutions. Despite the stock’s robust growth, investors should remain cognizant of possible risks. SMCI may be a worthwhile addition for those looking at the long-term.

Faqs

Is Super Micro Computer stock a buy or sell?

While Super Micro Computer has demonstrated robust growth, the choice to invest relies on market conditions, risk tolerance, and financial objectives. While analysts generally regard it as a strong long-term buy, short-term volatility is anticipated.

How high will SMCI stock go?

Predictions regarding stock prices differ, yet in light of the burgeoning AI and cloud computing sectors, certain analysts foresee a sustained upward trajectory. Nonetheless, outside market elements can affect its path.

Has SMCI been delisted?

No, SMCI has not been delisted. The company filed its delayed 10-K and 10-Q reports with the SEC on February 25, 2025, regaining compliance with Nasdaq listing requirements.

Is SMCI filing 10k today?

No, SMCI already filed its 10-K on February 25, 2025. There is no new 10-K filing reported for today, March 27, 2025.