Gulf Markets Recently, there has been volatility in the Gulf stock markets as investor confidence is affected by worries about possible US tariffs. Fears of an economic slowdown have been heightened by the ambiguity surrounding international trade rules, especially in economies that rely heavily on oil.

Major Gulf indexes have so fluctuated, with different degrees of damage seen by important industries like manufacturing, energy, and finance. This article examines the reasons behind the impact of US tariff worries on Gulf markets, the industries most affected, investor sentiment, and the financial picture of the area going forward.

Table of Contents

Why US Tariff Worries Impact Gulf Markets?

One of the main causes of the recent decline in Gulf markets has been investor apprehension over potential US tariff intentions. These tariffs, which target significant trading partners, might impact global trade, impacting energy prices and investor confidence in the region.

Many Gulf economies rely heavily on oil exports and international investment, so any shifts in trade patterns could lead to market instability. Furthermore, extended trade policy uncertainty may result in conservative investment plans and slower regional economic growth.

Key Gulf Markets Affected

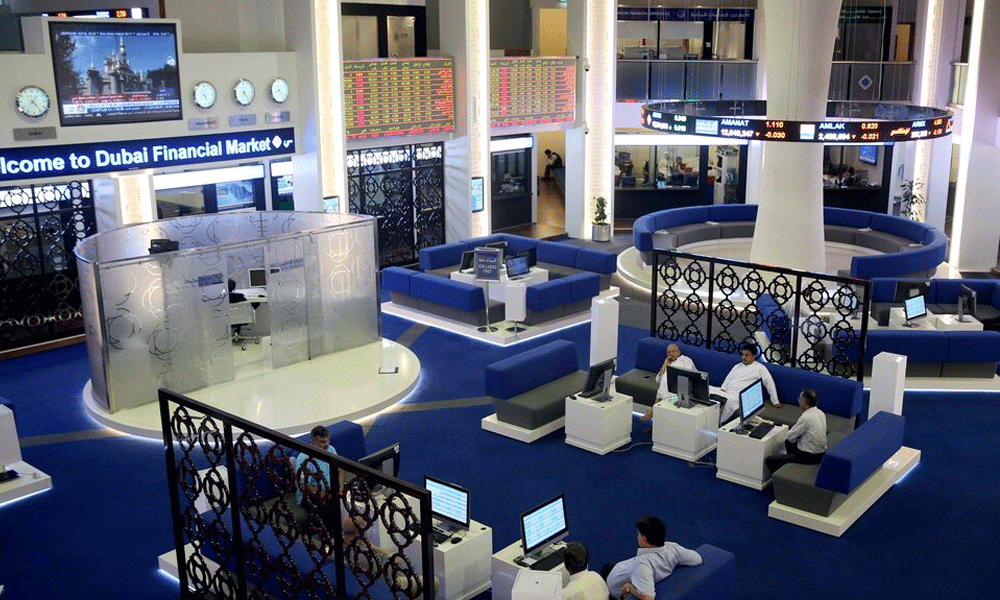

The main Gulf stock indices, including the Tadawul in Saudi Arabia, the Dubai Financial Market (DFM), and the Abu Dhabi Securities Exchange (ADX), have seen fluctuations.

The sectors most severely impacted are petrochemicals and logistics, both of which have strong export ties to the US. Because they are concerned that protracted trade hostilities may further erode market confidence, investors are keeping a careful eye on policy developments.

Furthermore, the region’s overall economic outlook has been impacted by the additional layer of uncertainty created by changes in oil prices.

Sector Wise Market Performance

- Oil & Gas: Fluctuations in crude oil prices have impacted energy stocks.

- Banking & Finance: Investor caution has led to mixed performance in financial stocks.

- Real Estate & Construction: A slowdown in foreign investments is causing concerns.

- Manufacturing & Trade: Possible supply chain disruptions have pressured the industrial sector.

Investor Sentiment & Economic Outlook

Gulf markets have experienced the indirect consequences of US tariffs on Chinese and European exports. Interruptions to the supply chain, rising costs for imported raw materials, and a drop in the volume of international trade are some of the primary problems.

Given that many Gulf economies rely on foreign direct investment and international trade, protracted tariff disputes may hinder the region’s economic development. Additionally, when companies and investors reevaluate their strategy in reaction to changing global trade dynamics, market volatility may increase.

What’s Next for Gulf Markets?

Gulf markets will keep a careful eye on US trade policies, changes in the price of oil, and regional economic reforms going forward.

In order to stabilize markets, policymakers may implement policies like more fiscal spending or incentives for foreign investment. To further reduce such dangers, initiatives to improve economic diversification and fortify non-oil sectors would be essential.

Conclusion

Long-term fundamentals are unaffected, despite the fact that US tariff worries have caused a decline in Gulf markets. In order to reduce such hazards, diversification initiatives and proactive economic measures will be essential.

In order to stabilize markets and increase investor confidence, governments in the area may also implement policy changes. In order to manage market uncertainty, investors are encouraged to maintain awareness and take a calculated strategy.

FAQS

How do US tariff concerns impact Gulf markets?

US tariffs on key trading partners can disrupt global trade, affecting oil prices and investor confidence in the Gulf region. Since Gulf economies rely heavily on oil exports and foreign investment, any shift in trade policies may lead to market volatility and economic uncertainty.

Which sectors in the Gulf are most affected by US tariff worries?

The most impacted sectors include oil & gas, banking & finance, real estate, and manufacturing. Fluctuations in crude oil prices, reduced foreign investments, and potential supply chain disruptions contribute to uncertainty in these industries.